“The more stubborn costs”

In November of last year, we wrote about how Small Businesses are an indicator species that help us “diagnose the health” of our economic ecosystem. Though we discussed the latest ISM surveys last week to see what they could tell us about the labor market, this week adds another voice to the frog chorus in the form of the NFIB’s Small Business Optimism Index.

While the SBOI provides good insight into the potential path for various labor metrics (discussed below), it also gives a read on inflation. The latter is perhaps at the top of mind given today’s CPI release (which came in line with expectations across Headline and Core, both on the MoM and the YoY basis), and on that subject, the latest readings could give the Fed some hope. While the NFIB’s commentary noted that “Owners continue to call inflation their top business problem, lamenting the cost increases for their inputs”, a quick and dirty model using the SBOI Planned Prices metric, adjusted for gas price changes, shows that headline prices could cool dramatically in coming months even if it is just the trend and not the level that holds true.

After today’s CPI numbers, markets appear to share a similar outlook, with expectations for the Fed’s next meeting continuing to shift towards a 25-bps hike, as shown in the latest from the CME’s FedWatch Tool.

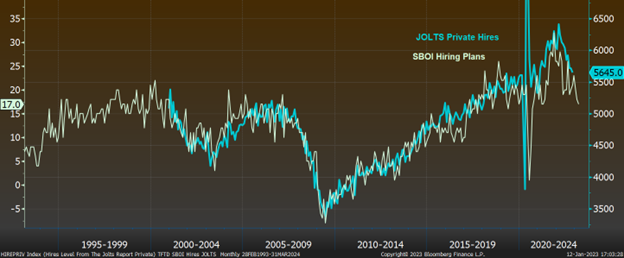

Such a cooling off in prices may, however, be stymied if labor costs remain elevated (which is at the heart of why Powell et al seem fixated on Core Services ex Housing). The NFIB’s report commentary noted, “When the cost of inputs like fuel or inventory fall, cutting selling prices is easy as owners try to attract more customers. But wages are very sticky, it’s hard to ask workers to take a cut so that selling prices can be reduced”. While this may be true, the NFIB’s data bodes well for at least a cooling of the labor market, if not an outright slowing. This could come as a surprise given that “Labor quality remains second place behind inflation… as the top business problem” and that 93% of owners hiring or trying to hire “reported few or no qualified applicants for the positions they were trying to fill”. Yet using the SBOI’s numbers to roughly gauge the wind reveals there may be shifts on the horizon. The Compensation reading is commensurate with the Atlanta Wage Growth tracker slowing down toward 5%, while Hiring Plans imply that JOLTS hiring has the potential for a 10% decline.

And while Yogi Berra’s words about predicting the future come to mind (as opposed to his thoughts on theory), the SBOI’s Earnings Changes reading indicates a bracing increase in the unemployment rate.

While this last outlook might be a bit rough around the edges, the Fed itself, as shown in the December SEP, expects (if we may use the median) Unemployment to reach 4.6% in 2023. However, while some slowing in the labor market may be its goal, as its own research warns, the Fed should be mindful of the saying, “Be careful what you wish for, lest you get it”.

P.S. While the quick and dirty models we’ve shared above may give a taste of what is possible, they certainly aren’t infallible. Take, for example, the model below, which we discussed in November 2019. While some of the NFIB’s commentary that we shared in that newsletter was eerily and unexpectedly accurate (“Only a major unexpected disruptive event can dent the economy in the near term.”) the model hasn’t quite captured the moves of the last year and a half or so!

P.P.S. In the PPS last week, we noted that Fed officials had contacts in construction who had concerns “about contract cancellations by purchasers”. These concerns appear to be well founded: KB Homes reported this week that its cancellation rate had jumped above 65%, well above even “the darkest days of the 2008-era crash, [when] the average builder cancellation rate only reached 47%”.